Provides reinsurance protection or solutions for general insurance companies with a coverage of all general insurance products, both proportionally and non-proportionally.

General Reinsurance Product

1. Fire

Providing reinsurance cover for loss and or damage to property; and or the insured interest along with business interruptions experienced when there is damage or loss in accordance with the rules guaranteed in the policy.

2. Engineering

Providing reinsurance coverage for loss or damage experienced during construction or installation of machinery, as well as protection of machinery and construction after the work is completed.

Engineering Insurance consists of two types:

1). Insurance that guarantees construction and installation work (project reinsurance). Engineering policies that guarantee construction and installation of machinery include:

- Contractor All Risk (CAR)

- Erection All Risk (EAR).

2). Insurance that guarantees in addition to construction work (non-project reinsurance). The engineering policy that guarantees in addtion to construction and installation of machinery include:

- Machinery Breakdown (MB)

- Electronic Equipment Insurance (EEI)

- Civil Engineering Completed Risk (CECR)

- Comprehensive Machinery Insurance (CMI).

3. Marine Cargo

Providing reinsurance protection againts damage or loss of the ship's frame along with its driving machines as a result of things that are guaranteed in the policy.

4. Marine Hull

Providing reinsurance protection against damage or loss to the framework of the vessel and its propellers as a result of risks guaranteed under the policy conditions.

5. Aviation

Providing reinsurance protection on aircraft, machinery and or various other equipment and also guarantees legal liability to third parties.

Coverage that may be granted in the Aviation reinsurance includes:

- Hull, Spares, Equipment and Liability Insurance;

- Deductible Insurance;

- Hull War and Allied Perils Insurance;

- Aviation War, Hijacking and Others Perils Excess of Liability Insurance.

6. Motor

Provide reinsurance for motor vehicles from loss or damage due to collisions, one-side accident, fire and theft. The coverage can be extended, including legal liability to third parties, personal accident, riots, terrorism and sabotage, as well as floods and earthquakes.

7. Miscellaneous

This reinsurance cover includes:

Personal Accident Insurance

Provide compensation for death, permanent disability (either partially or completely), temporary disability (partially or completely) and compensation for medical expenses due to personal accidents. For example Personal Accident, Travel Insurance.

Burglary Insurance

Covers the insured loss of goods stored in an insured building, caused by theft and demolition with acts of coercion and destruction.

In this case, the elements of coercion and destruction are absolute conditions for obtaining replacement. Items that are exempted are money, checks, shares, motor vehicles and accessories, glassware, other people's property brought to the insured location and items located outside the house.

In general, Bulglary Insurance is an extension of Fire Insurance.

Liability Insurance

Liability Insurance provides protection to the insured against risks from demands from other parties (Third Parties) in connection with the insured's personal/company activities.

The products of Liability Insurance which can be covered, include:

- Commercial General Liability (CGL)

- Automobile Liability

- Employers Liability

- Public Liability

- Stevedore Liability

- Workmen's Compensation

- Professional Indemnity

- Freight Forwarder Liability

- Bailee & Warehousemen Liability

- Director's and Officer's Liability

Billboard Insurance

Providing coverage for material damage of the Billboard and Third party Legal Liability (TPL) for the object insured.

Hole In One Insurance (HIO)

Provide protection to the committee/sponsor in the golf game for the prizes that have been determined due to the occurrence of Hole In One at the specified hole. Generally what is guaranteed in insurance is a hole with PAR 3.

8. Credit Insurance

Provide reinsurance protection for credit insurance products, counter bank guarantees and surety bond.

Credit Insurance

It is protection provided by the insurance company (surety) to the bank (insured) for the risk of debtor failure in paying off the credit facility or cash loan (cash loan/direct loan). Examples: working capital loans (revolving), transactional and other working capital loan (multipurpose loans, investment loans) provided by banks to their debtors.

Counter Bank Guarantee

Guarantee from surety (insurance company)on a bank guarantee issued by bank to the principal's interest as required by the obligee. In this case, surety has been bound to give compensation to the bank for the bank guarantee claim submitted by the obligee.

Surety Bond

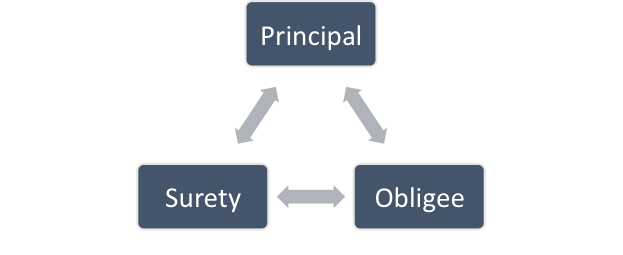

A three parties agreement beetween surety (insurance company) and principal (contractor) to guarantee the interest of the obligee (project owner), if principal fails to fulfill the obligations as agreed with the obligee then the surety will be responsible for the obligee to complete the principal obligation.

Types of coverage include :

- Bid Security

- Performance Bond

- Advance Payment Guarantee

- Maintenance Guarantee

- Payment Guarantee

- Procurement Gurantee