Compulsory Motor Vehicle Insurance, Is It Time?

Preface

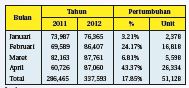

"Car sales speed up" was the title of one of the writings in a national newspaper. The title is supported by data showing that car sales from manufacturers to dealers (wholesales) in April posted an increase of 43.36% from the same month last year. Overall, for the same position (January - April) car sales recorded a growth of 17.85%, or an increase of 51,128 units (see table below)

Source: Gaikindo, Bisnis Indonesia

One of the car manufacturers from Japan claims to record the history of the sale of its newest variant. It is said that before the car was launched in the market, the number of indents had reached 3000 units. It's a pretty fantastic thing. The car has not been launched yet but public interest is very high.

Even though there is a new regulation from Bank Indonesia regarding the minimum increase in DP (down payment), it seems that car sales will not experience a significant shock. According to the author's observations, with high public interest and consumption, car sales will continue to grow, although not as large as the previous period.

The picture is of course a positive thing for business development. From an insurance business point of view, it will automatically affect the sales of motor vehicle insurance policies and of course this is an opportunity. But on the other hand, the increase in the number of vehicles also has an impact on congestion and vehicle density on the road. If this is not balanced with adequate infrastructure development, it is unimaginable what Jakarta will be like in the next 5 -10 years.

In addition to the impact of congestion caused by the increase in the number of vehicles, of course we also need to look at the level of accidents that have occurred both on roads and tolls. It is very possible that the number of accidents will increase because the roads are getting denser. If an accident occurs, who pays the cost? This is where insurance comes into play. Indeed, new vehicles, especially purchases on credit, are automatically protected by insurance. But when the credit period is over, do the vehicle owners still want to extend their policy? Given that insurance is a cost.

This is where the question arises, is compulsory motor vehicle insurance in Indonesia already necessary? Is it very urgent to be implemented?

Growth in the number of vehicles and Accident Rate

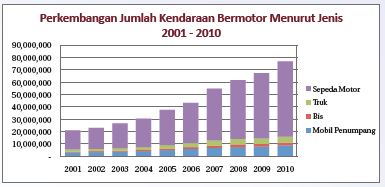

If we previously reviewed the growth of new cars, now we will see the growth in the number of national vehicles over the last 10 years (2001 - 2010). The growth or development of motorized vehicles over the last 10 years can be seen in the graph below:

Source : BPS dan Kantor Kepolisian Republik Indonesia

From the graph above, it shows that the development of the number of motorized vehicles shows an increasing trend. Motorcycles dominate motor vehicle sales, with a composition never being less than 75% of the total number of motorized vehicles each year. Then how does it affect the level of traffic or road accidents that occur? Is the number of motorized vehicles increasing, will the accident rate increase?

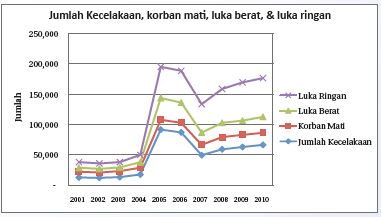

Source :BPS & Kantor Kepolisian Republik Indonesia

From the graph above we can see that although there was a decrease in the number of accidents in 2007, the trend shows an increasing trend. From 2007 to 2010, the number of accidents shows an increasing trend. In fact, according to data reported by Tempo, during 2012 until the 13th day of February the number of accidents had reached 9,884 incidents with the death toll from traffic accidents reaching 1,547.

With the increase in the number of vehicles, the number of accidents due to motorized vehicles also increases. If the number of accidents increases, then the cost of losses, both moral and material, who will bear it? The answer is clear, Insurance! However, do all existing vehicles have insurance protection? Specifically the responsibility to third parties? According to the author, we are more concerned with protecting own damage or damage to our vehicles, compared to the responsibility to third parties.

Motor Vehicle Insurance

A little description of motor vehicle insurance in Indonesia. According to AAUI data, in 2011 motor vehicle insurance premiums experienced a growth of 13.8% compared to 2010. Gross claims also increased by 10.5% from 2010. However, the claims ratio for 2011 was 42.9%. There is still a profit margin from this business.

Then what about the number of motorized vehicles that are insured? Cars for example. Statistics for 2010 according to the Indonesian National Police, the number of passenger cars reached 8,891,041 units. According to AAUI, the total gross premiums of motor vehicles in 2010 were recorded at 8.96 trillion rupiah. This is according to these assumptions:

- 60% of motor vehicle insurance premiums are contributed by private vehicles.

- The sum insured is IDR 150 million - IDR 300 million

- Comprehensive premium rate 2.75%

The insured number of vehicles will be no more than 1.5 million vehicles. This means that it is estimated that only 17% of the total number of vehicles are insured of the total existing cars. There are still quite a lot of uninsured vehicles.

Compulsory Motor Vehicle Insurance

Some time ago, the author had the opportunity to travel to Japan. The country applies compulsory motor vehicle insurance called CALI (Compulsory Automobile Liability Insurance). This scheme requires motorized vehicle owners to have insurance, especially Third Party Liability. The Liability component becomes mandatory. No need to go all the way to the land of Sakura, neighboring countries such as Malaysia and the Philippines have also implemented compulsory motor vehicle insurance.

Closing

As a closing, attached is 2010 data for the motorized vehicle population in Southeast Asia. It can be seen from the table that the number or population of motorized vehicles in Indonesia reaches 50 million units. Thailand is in 2nd place with a population of 25 million.

Source : duniaindustri.com, GAIKINDO, AISI

The implementation of compulsory motor vehicle insurance still requires an in-depth study, which involves practitioners, associations and regulators. It is also necessary to think about the scheme and the amount of limits that can be given. However, as a country with the largest motorized vehicle population in Southeast Asia, isn't it better for compulsory motor vehicle insurance to be implemented?

(Reinfokus edisi II, tahun 2012)

Author

14448

14448

.JPG)

08 Jan 2017

08 Jan 2017 12928 kali

12928 kali