Insurtech, an Opportunity Disguised as a Threat

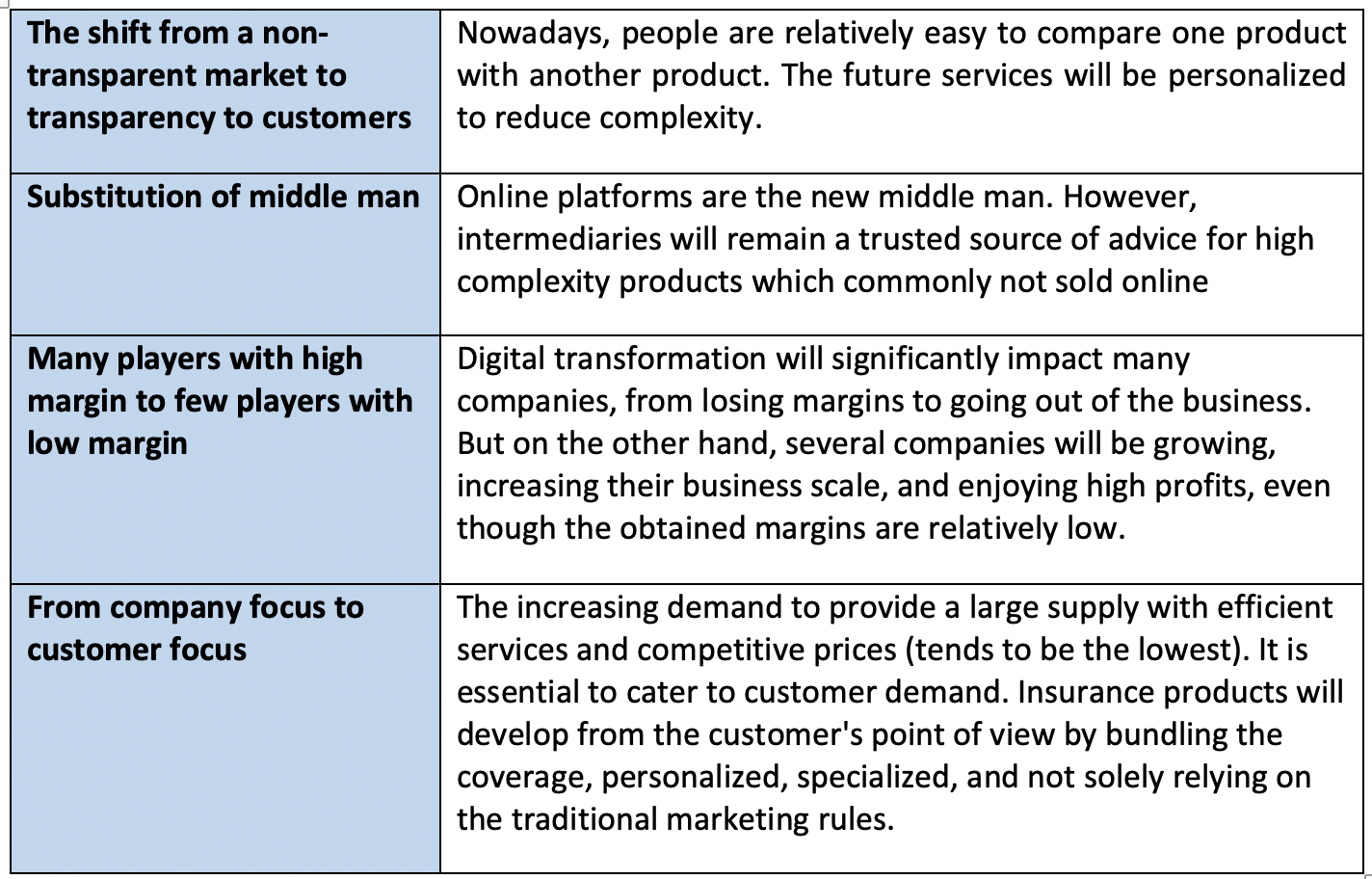

The word "threat" can be considered overheard when talking about things related to disruption. Technological innovation has caused many changes in business schemes that started to threaten incumbents. For example, ride-hailing applications have shifted the absolute popularity of conventional taxis, which eventually forced them to implement technology in their service base. This is also impacted the financial services industry. Financial technology or Fintech has become a common thing, especially for the millennial generation, who have grown and developed along with technological innovation. However, in Indonesia, technology-based financial services are still dominated by banking-related services. Although, several players in the insurance industry are implementing technology-based services, which is popularly called insurance technology (Insurtech).Quoting Alex Ruthemeir, an Insurtech facilitator, there are 4 main factors that greatly affect the industry in the Insurtech era, including:

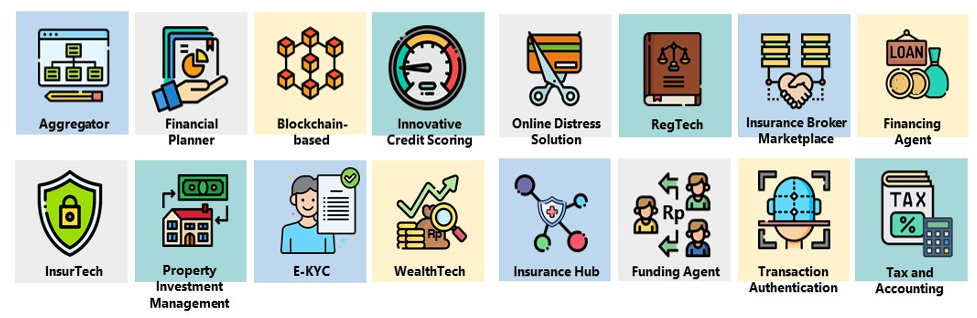

In 2018 the Financial Services Authority or OJK issued Regulation No. 13/POJK.02/2018 (POJK IKD), which regulates the implementation of digital financial innovation in the financial services sector. The OJK describes digital financial innovation as the activities of updating business processes, business models, and financial instruments that provide new added value in the financial services sector by involving the digital ecosystem. The players are categorized into the banking sector, capital market, insurance, pension funds, financing institutions, and other financial service institutions. So we could call this an umbrella regulation for digital innovation in financial services. According to the report from OJK regarding the list of digital financial innovation providers, which registered as of August 2021, the players are divided into several parts, among others:

Source: Otoritas Jasa Keuangan

According to the above picture, several clusters are related to the implementation of technology in the insurance industry, including Insurance Hub, Aggregator, Insurtech, and Insurance Broker Marketplace. Currently, the group with the highest providers is in the cluster of Aggregator with 32 registered providers, although not all of them provide insurance services. Overall, only a few providers offer services related to insurance, which can be an opportunity for those who want to bring the popular insurtech mechanism from abroad or develop the new services, especially for the incumbent. Sooner or later, there will be shifts in the pattern of society and economy in the age of digital transformation. Many insurtech startups are funded by incumbent insurance companies, as well as venture capitalists. According to the World Insurance Report 2019, traditional or incumbent and new companies find that collaboration offers a mutually beneficial path.

Those who want to become an insurtech providers must meet these particular criteria determined by the OJK, as follow:

-

Innovative and forward-looking;

-

Using information and communication technology as the primary tools of providing services to consumers in the financial services sector;

-

Support financial inclusion and literacy;

-

Useful and can be used widely;

-

Can be integrated into existing financial services;

-

Using a collaborative approach; and

-

Pay attention to aspects of consumer protection and data protection.

In order to ensure that the insurtech providers have fully met the criteria, OJK has prepared a playground for insurtech providers through the regulatory sandbox as a mandate given by the POJK IKD. This mechanism is carried out as a test conducted by OJK to assess the reliability of business processes, business models, financial instruments, and governance of the organizers. Therefore, the fully launched app will fulfill the above criteria. Digital innovation is coming faster. There will be some new players who are more adaptive to take the existing niche market. However, incumbents will be among the winners who can apply insurtech in their services. Some players are aware of the challenges and will transform.

References:

VanderLinden, Sabine, “The Insurtech Book: The Insurance Technology Handbook for Investors, Entrepreneurs and Fintech Visionaries”, (United Kingdom: John Wiley & Sons, 2018)

Peraturan Otoritas Jasa Keuangan No. 13/POJK.02/2018 tentang Inovasi Keuangan Digital Di Sektor Jasa Keuangan

Otoritas Jasa Keuangan, “Daftar Penyelenggara Inovasi Keuangan Digital”, Agustus 2021 https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Documents/Pages/Penyelenggara-IKD-dengan-Status-Tercatat-di-OJK-per-Agustus-2021/DAFTAR%20PENYELENGGARA%20INOVASI%20KEUANGAN%20DIGITAL%20PER%20AGUSTUS%202021.pdf

Insurtech Startegic Innovation by Mandiri Capital https://mandiri-capital.co.id/wp-content/uploads/2020/06/DSResearch_MCI_Insurtech_Public_compressed-1-dikompresi.pdf

https://www.ojk.go.id/GESIT/More/Foto/16

Penulis

4045

4045

18 Jul 2022

18 Jul 2022 3672 kali

3672 kali