Providing a “Playground” for Insurtech Through the Regulatory Sandbox

After exploring insurtech in my previous article, “Insurtech, an Opportunity Disguised as a Threat”, it appears that there are many insurtech players in Indonesia with various business models and services. With a dynamic business ecosystem, regulators need to take steps to manage this innovation strictly but not rashly. Therefore, insurtech could provide services that are responsible, safe, prioritizing costumer protection, and have a well-managed risks. In order to achieve that, the regulator needs to design a "playing ground" for insurtech through the regulatory sandbox. This method has been widely implemented in several countries that are boosting their digital financial industry. The United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA) describes the regulatory sandbox as a regulatory approach, typically summarized in writing and published, that allows live, time-bound testing of innovations under a regulator's oversight. Novel financial products, technologies, and business models can be tested under a set of rules, supervision requirements, and appropriate safeguards. Indonesia already has a regulatory sandbox organized by the Financial Services Authority (OJK) as mandated by OJK Regulation No. 13/POJK.02/2018 regarding Digital Financial Innovation in the Financial Services Sector (POJK 13/2018). In this provision, OJK explains the regulatory sandbox as a testing mechanism carried out by OJK to assess the reliability of business processes, business models, financial instruments, and governance of the insurtech provider. The regulatory sandbox for digital financial innovation, including insurtech, will be organized by the OJK Innovation Center for Digital Financial Technology (OJK Infinity). The functions of OJK Infinity itself include:

-

Facilitating the regulatory sandbox as a fintech incubator for balancing the innovation with consumer protection;

-

As an innovation hub for the development of the Digital Finance Industry (DFI);

-

As an education center for financial service players, consumers, and academics who will become the future DFI activists

Inside the Regulatory Sandbox

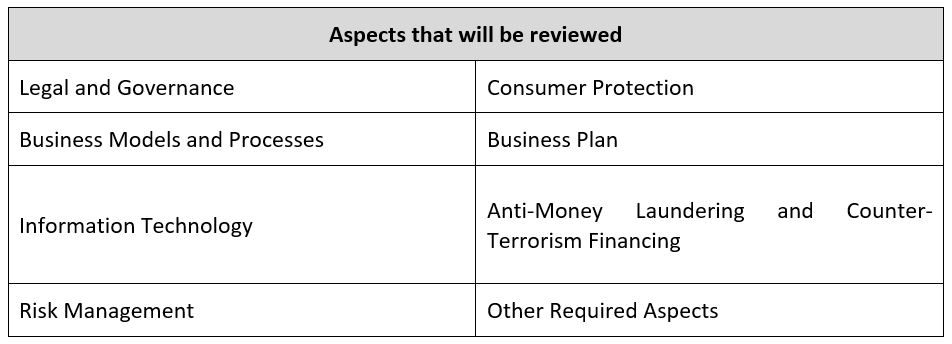

According to OJK Circular Letter No. 21/SEOJK.02/2019 regarding the Regulatory Sandbox, OJK Infinity will first determine several insurtech providers as a prototype. Prototypes are insurtech providers whose business models and business processes are used as sample objects to be tested in the regulatory sandbox, which will be used as a reference for reviewing the other similar insurtech providers. Insurtech prototypes must meet specific criteria, including (i) having the highest business complexity, (ii) having the largest business scale, (iii) having the highest risk exposure, and/or (iv) using the most advanced technology. Insurtech providers who are appointed as prototypes will deliver presentations to OJK regarding their business models, innovations, and other required information. Furthermore, the testing will be carried out by submitting a product trial scenario to OJK within 20 (twenty) days after being selected as a prototype. There are several aspects that will be tested and evaluated by OJK in the regulatory sandbox, among others:

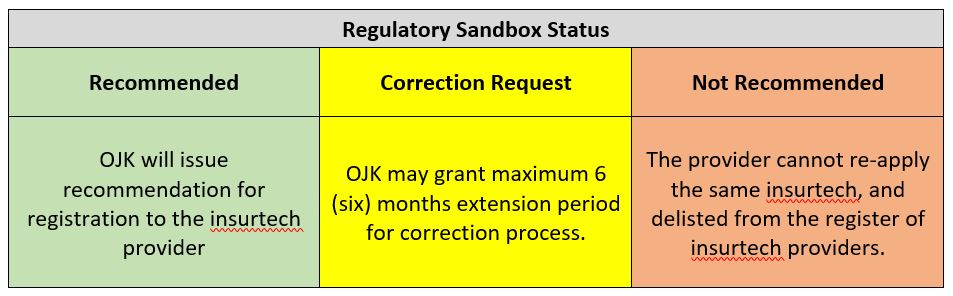

The testing process can be carried out through an electronic system and/or manually. In addition, OJK can also conduct onsite observations to the data center of the insurtech provider and/or disaster recovery center. According to POJK 13/2018, insurtech providers who are in the regulatory sandbox could submit a request to OJK to be temporarily excluded from certain OJK regulations. However, insurtech providers must meet several requirements, including (i) the insurtech provider is in the regulatory sandbox; (ii) obtaining approval from the related unit at OJK; and (iii) temporary exceptions only apply to non-prudential OJK regulations. The Regulatory sandbox will be held for a maximum period of 1 (one) year and extendable for another 6 (six) months. Later, OJK will determine the testing results with the status below:

Insurtech providers that are not selected as prototypes in the testing process will follow the testing result of the prototypes in similar clusters. However, there might be several adjustments according to the results of the regulatory sandbox. For the prototypes that get the status of "not recommended" and currently running their business, they must stop their business activities. This also applies to insurtech providers who are not included as prototypes but are in the same cluster as the prototypes that get the status of "not recommended". However, prior to the closure of its business activities, the insurtech providers must complete all its obligations to consumers and other parties within 6 (six) months or the longest remaining contract term since obtaining such status from OJK. The digital financial industry ecosystem is a community consisting of authorities, providers, consumers, and other related parties. The role of all parties is required to be able to create sustainable, safe, and beneficial insurtech for all parties. The regulatory sandbox is only one of many ways to make this happen. Technology will always be one step ahead of the regulations. However, OJK as the regulator, has taken further steps to be adaptive in dealing with technological developments.

Penulis

4644

4644

18 Jul 2022

18 Jul 2022 3672 kali

3672 kali